kentucky sales tax calculator

Kentucky Sales and Use Tax is imposed at the rate of 6 percent of gross receipts or purchase price. Kentucky has a 6 statewide sales tax rate but also.

Love Yourself Beauty Online How Do I Find My Tax Rate For My Avon Business

Kentucky does not charge any additional local or use tax.

. Local tax rates in Kentucky range from 600 making the sales tax range in Kentucky 600. The Kentucky sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the KY state tax. Average Local State Sales Tax.

Kentucky has a flat income tax rate of 5 a statewide sales tax of 6 and property taxes that average 1257 annually. This takes into account the rates on the state level county level city level and special level. The average cumulative sales tax rate in Albany Kentucky is 6.

The state of Kentucky KY has a statewide sales tax rate of 6. The Kentucky sales tax rate is 6 as of 2022 and no local sales tax is collected in addition to the KY state tax. The average cumulative sales tax rate in the state of Kentucky is 6.

The average doc fee in Kentucky is 3151 and Kentucky law does not limit the amount of doc fees a dealer can charge. To lookup the sales tax. Sales and Gross Receipts Taxes in Kentucky amounts to 65.

Both the sales and property taxes are below the national. Exemptions to the Kentucky sales tax will vary by state. This includes the rates on the state county city and special levels.

This includes the rates on the state county city and special levels. Though the sales tax. Just enter the five-digit zip.

2022 Kentucky Sales Tax Table. The average cumulative sales tax rate in West Paducah Kentucky is 6. Kentucky sales tax details.

Kentucky has a state-level sales tax rate of 6 and the state does not offer reduced rates. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Maximum Possible Sales Tax.

How to Calculate Kentucky Sales Tax on a Car. To lookup the sales tax. Kentucky sales tax returns are always due the 20th of the month following the reporting period.

Kentucky imposes a flat income tax of 5. Calculate Car Sales Tax in Kentucky Example. The tax rate is the same no matter what filing status you use.

There are no local sales and use taxes in Kentucky. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish.

Albany is located within Clinton County KentuckyWithin. Overview of Kentucky Taxes. Maximum Possible Sales Tax.

Find your Kentucky combined state and local. This includes the rates on the state county city and special levels. The average cumulative sales tax rate in Summer Shade Kentucky is 6.

West Paducah is located within McCracken. Average Local State Sales Tax. Summer Shade is located within Metcalfe County.

Aside from state and federal taxes many Kentucky. The most populous county in. Exemptions to the Kentucky sales tax will vary by state.

Kentucky was listed in Kiplingers 2011 10 tax-friendly states for retirees. Due to this businesses can expect to collect and remit a 6 sales tax rate on all taxable sales they. The state of Kentucky has a flat sales tax of 6 on car sales.

Sales and Use Tax Laws. The base state sales tax rate in Kentucky is 6. If the filing due date falls on a weekend or holiday sales tax is generally due the next business.

Kentuckians Included In The Federal Disaster Declaration For Individual Assistance Are Eligible For A Refund Of Kentucky Sales Tax Q95fm

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Texas Sales Tax Rate Changes October 2018

How To File And Pay Sales Tax In Kentucky Taxvalet

Tax Calculator Mccracken County Pva Bill Dunn

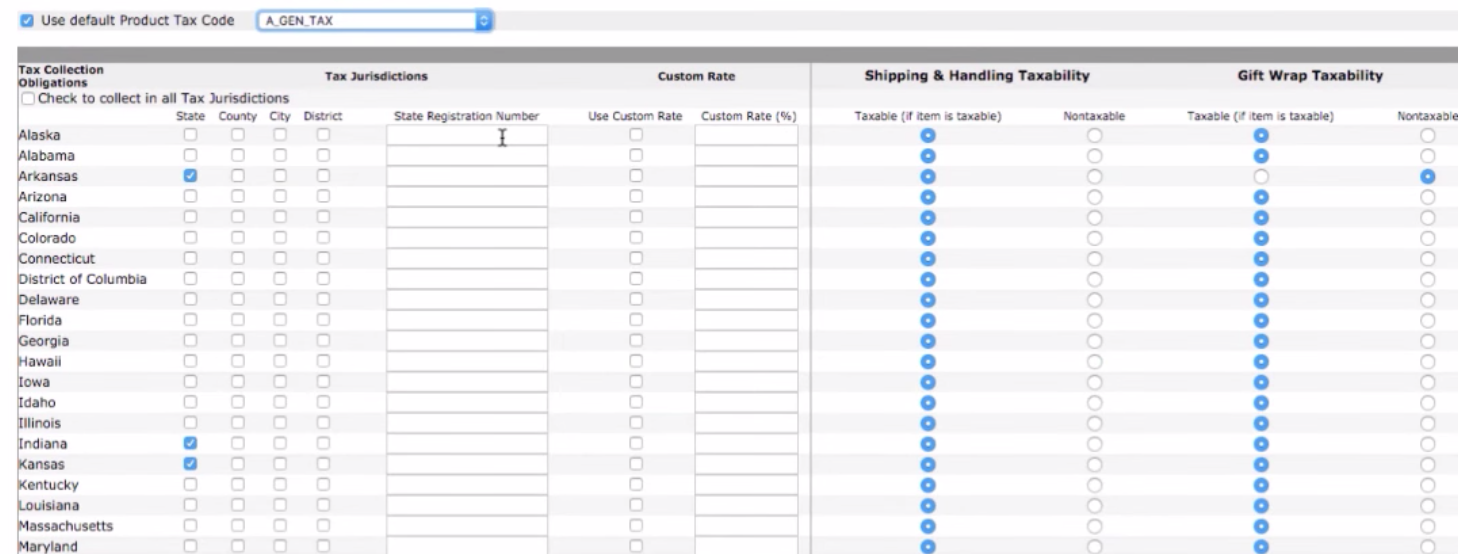

Amazon Sales Tax Everything You Need To Know Sellbrite

Fulton Kentucky Sales Tax Calculator 2022 Investomatica

Kentucky Income Tax Calculator Smartasset

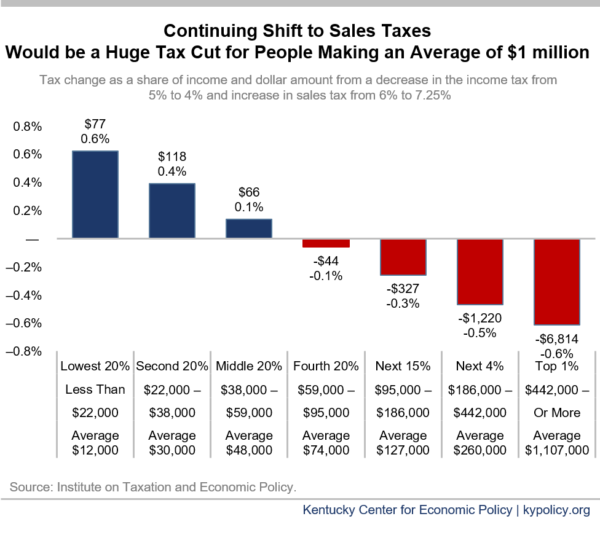

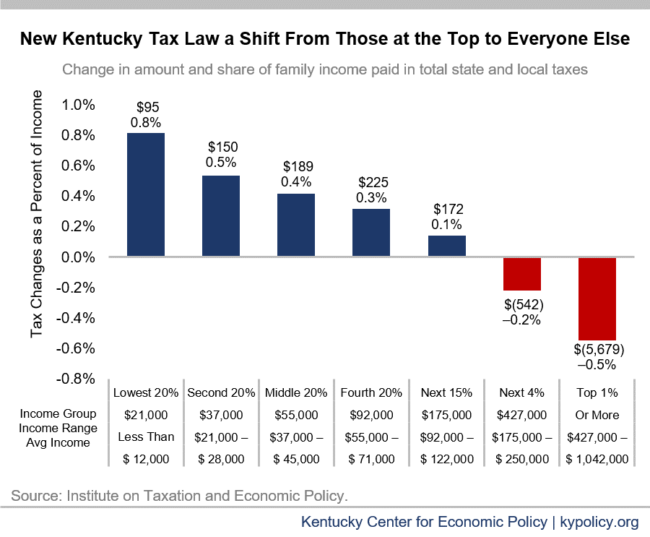

Further Shift From The Income Tax To The Sales Tax Is Bad For Kentucky Kentucky Center For Economic Policy

How To Do Payroll In Kentucky What Employers Need To Know

Sales Tax Calculator And Rate Lookup Tool Avalara

Kentucky Sales Tax Rate 16th Highest In Nation Louisville Business First

Auto Loan Calculator With Tax Tag Fees By State

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

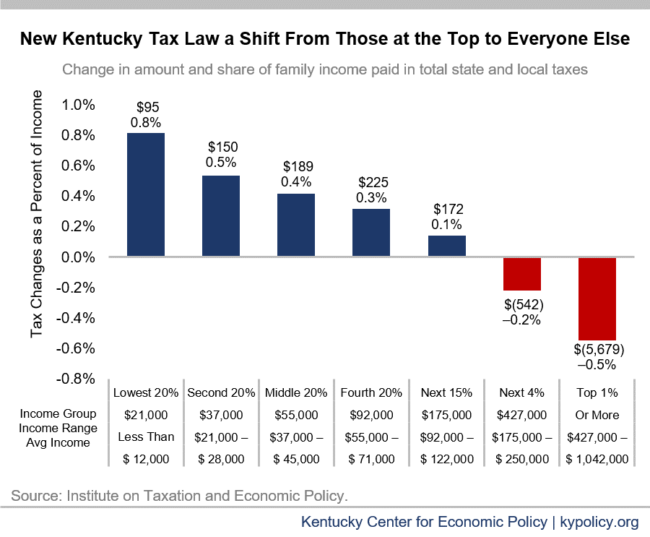

Kentucky Tax Shift Going Into Effect Kentucky Center For Economic Policy

Kentucky Vehicle Sales Tax Fees Calculator Find The Best Car Price

States With The Highest Lowest Tax Rates

Hopkins County Taxes Madisonville Hopkins County Economic Development Corporation